Private school isn’t cheap, but there are options across the country for parents to enrol their kids in a top-notch educational institution. But when you have to pay close attention to your finances on a month-to-month basis, trying to find ways to pay for tuition and the associated costs of private school can be overwhelming.

We recommend investigating what's available. “Don’t be shy about asking about needs-based scholarships and applying,” says Elena Holeton, director of admissions at St. Clement’s School in Toronto, Ontario. “Know that the admissions departments are very happy to have these conversations, and that these types of questions are nothing to be embarrassed about. A lot of people are stretching to be able to afford independent schools, and questions around financial aid are not uncommon.”

Making independent schools more accessible is a win-win scenario for all students, even those who aren't on the receiving end of financial support. "Diversity enriches campus life in countless ways," says Graham Brown, from Brookes Westshore School, in Victoria, BC. "You're bringing in students who are really motivated, and a lot of diversity is useful in the classroom."

If you think independent school is right for you but you're not sure if you can afford it, fret not: financing your child’s private school adventure can be done.

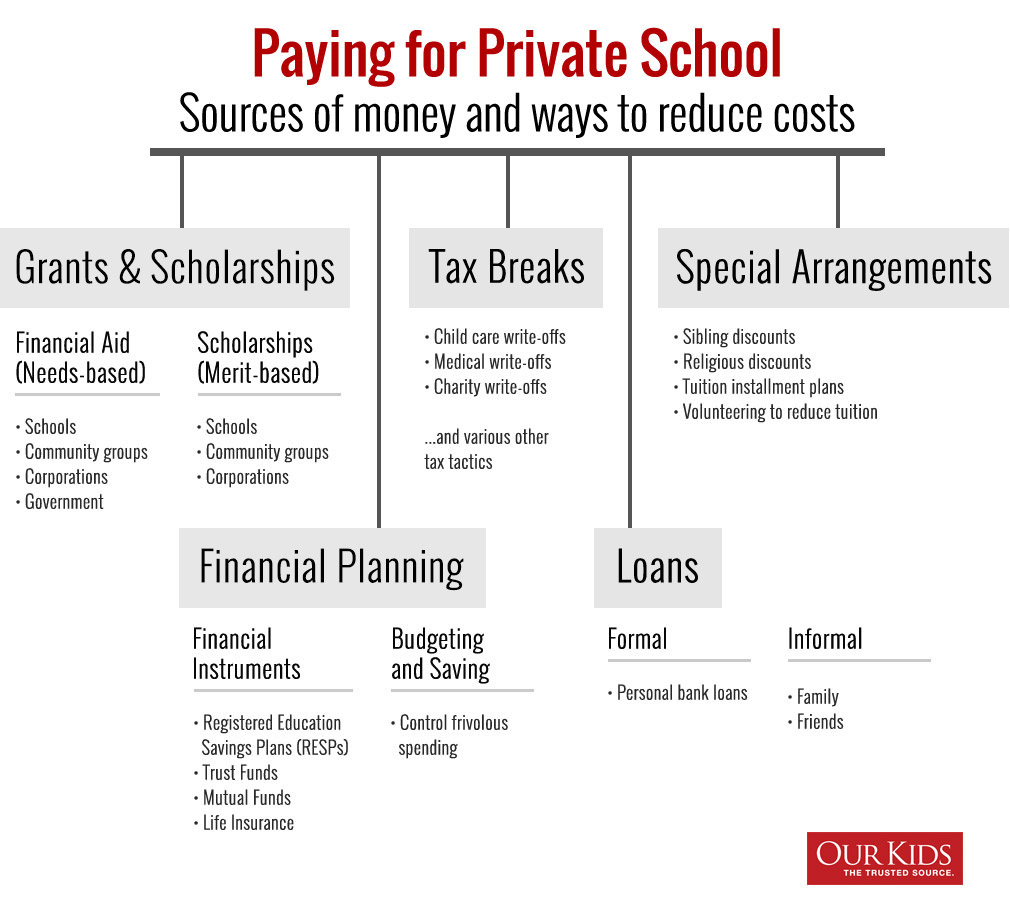

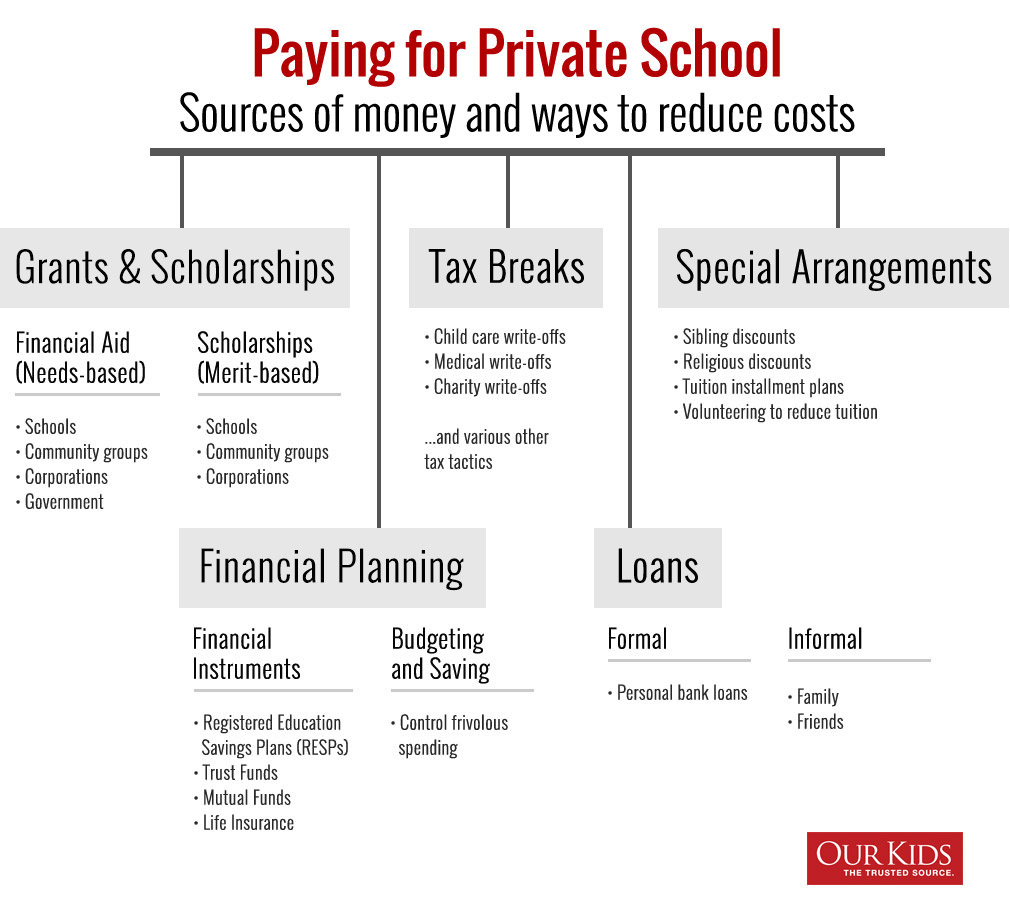

Below, find 18 tips to help you navigate the cumbersome financial requirements and find success for your child in the private school system.

Beginning the research

1. Keep an open mind—because the private school industry has changed

Financial assistance has changed over the past 10 years, according to Kathy LaBranche, director of admissions at Trinity College School (TCS) in Port Hope, Ontario. "It's becoming more and more important," she says.

In fact, TCS offers $3.5 million in financial assistance each year. "The movies would have you believe private school is just for the elite, but the face is changing," LaBranche says.

2. Shop around

It’s important not to get discouraged if the first school you call has a really high tuition rate. In some cases, tuition can be fully funded by the government or other sources and cost nothing, or it can be as high as tens of thousands of dollars a year. You may be able to find an independent school that meets your criteria and costs much less than the first school you looked into does.

3. Have questions? Ask them all!

Be upfront about your financial situation, and ask the school for recommendations on how to afford it. Sometimes creative solutions are available. Goodwill from schools to help parents is remarkable to some education experts and can be one way to help handle the cost of tuition. For instance, on expert says he has heard of a school allowing a father to work night shifts as a custodian as a way to earn extra money to finance his child's tuition and gain access to a staff discount.

"One should always ask about ways to make it work. Schools are always looking for strong students," Brown says. "We're all educators. We want to help students."

4. Ask if the school will accommodate a flexible payment plan—or accept volunteer hours towards payment

"Most schools do offer payment plans," Thomas says. "It doesn't hurt to ask. All they can say is no."

Dr. Howard Bernstein, psychologist and executive director of the Chisholm Centre, which offers special education services, says its school in Oakville, Ontario, accommodates flexible payment plans when it can and has even allowed parents to spread out payments for two years of school over a four-year period. "We find different ways to help," he says.

Volunteer hours can sometimes, not always, be offered to help decrease the cost of tuition—although are rare. Some schools don't use volunteers at all, while some offer a wide range of benefits to parents. Don’t be afraid to ask the school directly during the admissions process, or to contact the school director or admissions department.

5. Investigate multiple-child discounts

"Many schools do have a family rate, and that can shave off hundreds of dollars a year," Thomas says. This is particularly common at faith-based schools (such as Christian, Catholic, Jewish, and Islamic schools), where discounts can start at 10 percent off the tuition for each sibling. Multiple-child discounts vary at each school but are often applied to the third sibling who enrolls.

From the Our Kids archives

Financial aid and scholarships

6. Apply for financial assistance

"Don't close the door before you start to look because you decide you can't afford it," LaBranche says. Even if you think your income is too high to qualify for financial assistance, it doesn't hurt to investigate what's available. Large established schools most likely have more financial aid options than smaller and newer ones. Some schools offer several scholarships, though families may be restricted to applying for only one.

Some schools offer scholarships for a student from a single-parent home, from the Cayman Islands, from Saskatchewan, or with exceptional art skills. Bursaries are the most common form of need-based financial assistance. They can range from partial relief to a full ride.

Students applying for scholarships will likely be required to write an essay outlining why they deserve the award. The best essays offer the award-giver a really descriptive profile of the potential recipient. Instead of a mere overview of all your achievements or involvement, give the school a glimpse into how your successes relate to your character.

7. And apply early!

The best rule of thumb is it's best to apply sooner rather than later for scholarships, as most schools have a rolling deadline. Because the application process can sometimes be lengthy, it’s crucial to stay ahead of the curve and not get bogged down last minute with a stack of applications and essays to write.

While entrance scholarships, given to students based on their grades, don't require a formal application, awards targeting academic, artistic, or athletic abilities (not to mention community service achievements) often do. "We've had students I would have liked to have taken on, but we had already used up our allotment," says Brown.

8. Look into community bursaries or scholarships

In Canada, you'll find plenty of non-academic scholarships for your child to apply for. Some of these include scholarships for community involvement, athletic and artistic achievements, and exemplary participation in school life.

"There are many other organizations that may offer scholarships, like sports groups, community groups, and religious groups," says Nancy Edmison, a certified financial planner with the Investors Group in Mississauga, Ontario. "Explore all of your avenues. It can be really worthwhile to look."

It's not uncommon for small communities to help pay to send local students to private schools, particularly if their own educational options are limited. Many students receive support from fundraisers organized by groups like the Rotary Club.

Another example is the Calgary-based Prosser Charitable Foundation's Parent's Choice Bursary, which supports 50 percent of tuition costs up to $3,500 per year for each student from a low-income family to attend a private or independent school not funded by any regional school board in the Calgary area.

Being selective is the best way to secure a non-academic scholarship. For example, join only a few clubs you're interested in and get involved deeply. A meaningful impact in a certain field is better than minimal involvement in many different settings.

9. Be prepared to lay your cards on the table when applying for aid

"People get stressed and embarrassed when talking about finances," LaBranche says. "Put your pride aside and be open and honest." Applying for financial assistance won't affect your child's chances of being accepted to private school since acceptance is based on whether the student is a fit and meets the school's academic and extracurricular criteria.

The application process can be taxing, as you will likely be asked to provide income statements, tax forms, and lists of assets. Make sure to mention any special circumstances that aren't reflected on your basic income statement, Brown recommends.

10. Corporations hand out bursaries too

Contact the human resources department of your employer about whether corporate-sponsored scholarships are offered. While many are intended for post-secondary schools, some companies offer scholarships for K–12 private schooling. For instance, the Investors Group has teamed up with the Knights of Columbus in Mississauga to sponsor an essay contest called "Leaders of Tomorrow," with a private school scholarship as the prize.

Government and taxes

11. Inquire about tax breaks and insurance coverage

The Canada Revenue Agency has a long-standing policy allowing a certain portion of the money paid to private schools to be earmarked as a charitable donation. The schools must be registered as Canadian charities that provide religious education, says Jennifer Horner, senior tax manager at BDO Canada LLP. The school must provide the donation amount by determining the percentage based on tuition and issue a donation receipt.

If your child has special needs, you may qualify for a medical tax break on tuition at eligible schools with specialized staff. Bernstein says many extended insurance plans will also cover initial psychological assessments at specialized schools like Chisholm, which can cost about $1,750.

Moreover, a portion of the fees can be an eligible childcare expense for private schools that offer programs for preschool-age children or after-school care for students up to age 15, including boarding schools, Horner says. The schools will usually determine this cost. For a boarding school, you may only claim up to $175 per week for a child under the age of seven years, $250 per week for an eligible disabled child or $100 per week for a child aged 7 to 16 years, as of 2013. If the child is disabled, parents can obtain more generous support.

There are affordable ways to protect your ability to pay for private school. Before you take the steps to enrol your child in private school it is important to ensure you have the proper protection in place. If the choice comes down to the cost of protection versus the cost of tuition there is only one way to proceed: find a different high -uality private school with lower tuition. There are no short cuts to having proper protection.

12. Research government support

"We urge families to find out if there's additional support for families in their situation, such as single-parent homes or immigrants," Thomas says. "Things always change at the government level, so check into it."

Some programs worth looking into are the Newcomer Settlement Program for new immigrants, the Ontario Child Benefit for low-income families, the Canada Child Tax Benefit for families with children under 18 years of age, the Childcare Expenses Deduction, and the CWELCC Subsidy Program.

The Nova Scotia Department of Education offers tuition support for students with special needs in a special education private school. Students who have been approved for funding may also be eligible for a tuition support supplement grant.

Planning your finances

13. Prioritize your expenses

"Families have ways of reducing their cost of living so they can put more income toward tuition," Thomas says. "For instance, I have known families that have moved in with grandparents."

While that may be an extreme example, there are other ways to trim your budget to prioritize education. "What might you be willing to give up or postpone? Retirement? Family vacations? Newer vehicles?" asks Ryan Challis, a certified financial planner at Winnipeg-based Nakamun Financial Solutions. Sacrificing extras like vacations, cable or a family cottage may be tough at times, so Challis recommends making a list of all the reasons you want to send your child to private school.

"Keep that list as a working document to refer back to in the years to come," he says. "There will be times throughout the child's school life when the parents question their decision to sacrifice things to send them there. Keep in mind the end goal for the child."

14. Start saving early

There are many opportunities to get ahead of the financial curve when it comes to saving for private school for your child.

The Tax-Free Savings Account (TFSA) is a great tool to accumulate savings on a tax-free basis for private school. If both parents max out their $5,000 TFSA contributions each year beginning when their child is born, by the time the child is six years old, they will have $60,000 in their private education fund.

Having that kind of capital can help parents snag tuition discounts at some schools that shave off as much as 10 percent for families that pay the entire year's tuition upfront rather than in installments.

For the vast majority of Canadians, a Registered Education Savings Plan (RESP) is the most effective way to create an education fund that grows to offset future education costs, however, there are other financial options available to you.

Formal trust funds are generally used for large sums of money, usually more than $50,000. These funds typically come with strings attached, such as how and when the money can be used. You need a lawyer to establish a fund, which means fees for set-up and annual administration. And the trust is a legal entity that has to pay taxes on income and dividends.

Another option to save money for school is through mutual funds. A mutual fund is usually opened in a parent's name. However, just as with an RESP, children need a Social Insurance Number to have their own accounts, no matter whether they are six weeks, six months or 16 years old.

Mutual funds provide the flexibility of accessing the funds at any time, changing investment strategies and using your money when and how you want.

15. Automate parallel university savings through vehicles such as life insurance

With so much energy dedicated to funding private school, it can be easy to forget about saving for university at the same time. Edmison recommends taking out a life insurance policy for your child when he or she is very young, and including an investment component. For instance, if you can spare $100 per month, you could hypothetically put about $30 toward permanent insurance, while the other $70 can be automatically invested.

"You can then transfer the ownership of the insurance to the child when he turns 18, and he can make withdrawals to pay for university," Edmison says. As an added bonus, your child is insurable even if he or she develops a health problem down the road.

Other considerations

16. Lean on grandparents or other relatives if possible

"We see a lot more grandparents involved," LaBranche says. Thomas agrees that support from relatives is increasingly common. "Often a grandparent will say, 'Let us take care of the tuition, and you take care of the other expenses,'" Thomas says.

17. Remember to budget for extra fees

"Make sure you have money set aside for extras," Thomas says. "There may be things like transportation costs and uniform fees that you wouldn't have to deal with at a public school."

18. Consider the extras you'll save money on

Many private schools include services and benefits in the cost of tuition, such as extracurricular fees, meals, and tutoring. "Think, ‘If my kid were here, what costs wouldn't I have?'" LaBranche says. You could save as much as $8,000 a year on hockey-related expenses, for example, since programs like sports are included in many independent school packages. LaBranche says other potential savings lie in gas expenses, as well as food and living expenses for boarding students. "It's a big ‘aha' moment for a lot of parents," she says.

Video: Tips on Paying for Private School

Attend information seminars on financial aid, including scholarships and tax breaks, at any of the Private School Expos every fall. These one-day events are a must for any parent or student considering an alternative education.

Related reading: