Trusted by families since 1998.

"I refer my clients to OurKids.net all the time. It's a practical resource for parents to examine and analyze their choices."

—Judy Winberg, M.Ed., Education Consultant

"Our Kids makes it easier for parents to navigate the choices they have around schooling. It's an excellent resource."

—Elaine Danson, Education Consultant

Featured in:

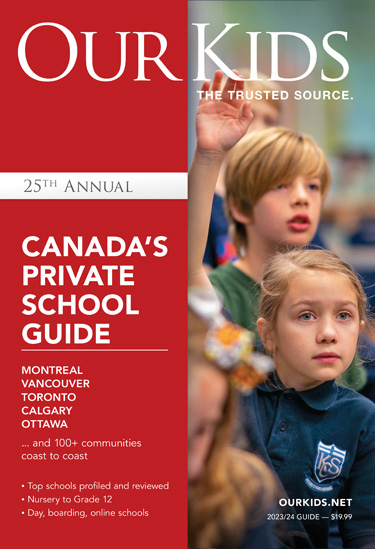

PRIVATE SCHOOLS

Now, more than ever before, private schools are options for families of all backgrounds seeking a solid educational foundation for their children.

With detailed profiles, reviews, and expert advice, Our Kids is the most trusted, comprehensive source for private schools in Canada.

Browse Schools

Create a customized shortlist.

Advice Guide

Learn about school benefits, types of schools, and admissions processes.

Compare Schools

Compare and rank schools based on your own selection criteria.

Advanced School Search

Find the schools that are right for you.

School Reviews

Gain insight from alumni, parents, and Our Kids editors.

Featured Events

Access key dates for open houses, virtual tours, and admission deadlines.

- Ontario

- Ajax

- Ancaster

- Aurora

- Barrie

- Belleville

- Brampton

- Brantford

- Brockville

- Burlington

- Caledon

- Campbellville

- Collingwood

- Durham

- Etobicoke

- Fort Erie

- Guelph

- Hamilton

- Kanata

- King City

- Kingston

- Kitchener

- London

- Markham

- Milton

- Mississauga

- Newmarket

- North York

- Oakville

- Oshawa

- Ottawa

- Pickering

- Port Hope

- Richmond Hill

- Scarborough

- St. Catherines

- Stouffville

- Thornhill

- Toronto

- Unionville

- Vaughan

- Waterloo

- Welland

- Whitby

- Windsor

- Wolffville

- Woodbridge

- York Region

- British Columbia

- Burnaby

- Coquitlam

- Kelowna

- Langley

- Lower Mainland

- Maple Ridge

- Nanaimo

- North Vancouver

- Richmond

- Summerland

- Surrey

- Tri-Cities

- Vancouver

- Victoria

- White Rock

- Quebec

- Kirkland

- Laval

- Longueuil

- Montreal

- Westmount

- Maritimes

- Halifax

- Lunenburg

- Saint John

- Alberta

- Banff

- Calgary

- Edmonton

- Saskatchewan

- Regina

- Manitoba

- Winnipeg

- Europe

- Poland

- United States

- US Boarding

- Connecticut

- New York

- Washington

- View all locations

- Living Arrangements

Boarding Schools

Day Schools

Online Schools

Homestay Programs - Gender

All-girls Schools

All-boys Schools

Coed Schools - Age Range

Preschools

Elementary Schools

Middle Schools

High Schools